This article first appeared in The Edge Financial Daily on May 4, 2017

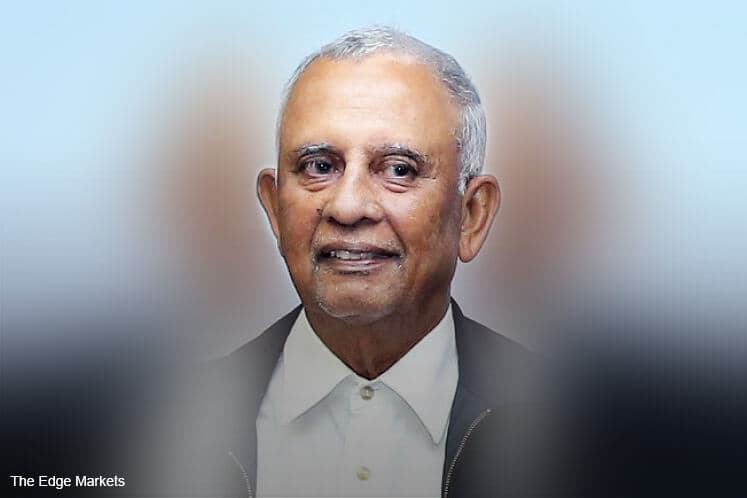

KUALA LUMPUR: A high level of accountability, freedom and access to information “is still very much lacking” in Malaysia compared with countries such as Australia, which has a more developed corporate governance regime, said former finance ministry secretary-general and Economic Planning Unit director-general Tan Sri Mohd Sheriff Mohd Kassim.

“If [the scandal involving] 1Malaysia Development Bhd (1MDB) were to happen in Australia, there will be a full-scale inquiry [by now],” he said in a roundtable discussion on the “Corporate Governance Watch 2016 — Ecosystems Matter” report released by the Asian Corporate Governance Association (ACGA) yesterday. The event was organised by the Malaysian Institute of Integrity.

Mohd Sheriff also highlighted the need for Parliament to provide oversight of the functions of the government to prevent abuse of power.

“The question is, if there is something wrong, will the government have the will to carry out or to take those responsible to court?” he asked.

He also raised the issue of independence that is a threat to public governance as seen in the Attorney-General’s (AG) Office.

“The Attorney-General acts as both the adviser to the government as well as a public prosecutor. But how can he be independent if he is the public prosecutor and the adviser to the government?” Mohd Sheriff said.

This was in line with the report released by ACGA that highlighted that the Malaysian AG’s Chambers had investigated the 1MDB affair until the AG was changed.

The report also showed that the Malaysian Anti-Corruption Commission, which does not have the power to prosecute, had decided to continue its own investigation into 1MDB after the new AG closed the case. However, its chief commissioner Datuk Seri Abu Kassim Mohamed quit his post on Aug 1, 2016, more than two years before his term was due to expire.

The Edge Media Group publisher and group chief executive officer Ho Kay Tat concurred, noting that the issue of governance has emerged following the 1MDB scandal.

The Edge Malaysia weekly and The Edge Financial Daily were also suspended for three months from July 27, 2015 over their reporting of the alleged graft at 1MDB, leading to growing concerns over press freedom in the country.

“It’s just unacceptable that the board (government) has decided to classify a report done by its own Auditor-General under the OSA (Official Secrets Act 1972) on this big issue.

“How serious can we take the board of the government then if their own report is classified as OSA? I think that’s where we have failed [in public governance],” Ho said, referring to the Auditor-General’s report on 1MDB which was classified under the OSA since its publication in February last year.

Nevertheless, Ho commended both the Securities Commission Malaysia (SC) and Bank Negara Malaysia (BNM) for pushing ahead with the reforms in regulations and enforcement.

“There’s no doubt since the 1997 Asian financial crisis, in terms of corporate governance of public listed companies, there has been tremendous improvement if not just the regulations and the enforcement by both the SC and Bursa Securities. There are still many miles to walk, but definitely there’s been improvement,” he said.

Malaysian Institute of Corporate Governance president Datuk Yusli Mohd Yusoff said the progress made to strengthen corporate governance by regulators has been respectable such as the new Malaysia Code of Corporate Governance that was released by the SC and the strong corporate governance requirements by BNM.

Yusli, however, raised the concern that the lack of accountability in the government, as reflected by the ACGA report that saw the political and regulatory environment’s score in Malaysia falling to 48% in 2016 from 59% in 2014.

“You cannot expect to have a high standard of corporate governance if the public governance culture is poor. It’s only going to be a matter of time before our corporate governance standards will fall down if we don’t improve public governance,” he said.

On the sidelines, Yusli told The Edge Financial Daily that the recent settlement between 1MDB and International Petroleum Investment Co (IPIC) requires more disclosure and transparency by the government to ensure that there is accountability.

“To me, when you talk about public governance, it’s all about being transparent. When you are talking about public finances, you need to be very transparent. The public needs to know contractually what the government is committed.

“If you don’t make it clear, people will speculate. The thing is, get the facts out; what’s the amount due to be paid to IPIC and what are we paying,” he said.

The ACGA report saw Malaysia’s ranking slip to sixth place from previous fourth placing, with the need to prioritise on public governance and corporate governance culture. The corporate governance watch score for Malaysia also dropped to 56% in 2016 from 58% in 2014.